For the supply chain, 2021 was a tough year with many challenges. Port congestion made it difficult to unload freight, truck capacity was tight due to the drivers’ shortage, shipping costs greatly increased, warehouses had limited space, the Covid 19 outbreak continued, and the list goes on. All these disruptions impacted the final customer and the entire logistics community.

We want to share with you accurate, valuable, and timely information about what’s going on in the transportation and logistics industry so you can develop a better approach to manage your current supply chain challenges and make better decisions.

This month’s video

Jay Foreman, Basic Fun! Toy CEO, discusses the supply chain pressures his company continues to face despite all the measures taken by the government to reduce ports congestion. Containers piling up, getting the empty containers back to the port, the shortage of containers, and increased transportation costs are some of the challenges that many companies continue to face. Click the video to learn more.

Spot Market Insights

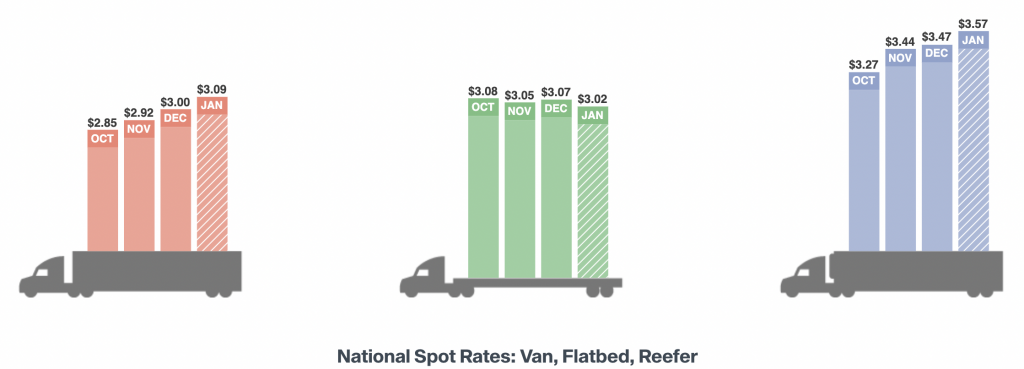

According to DAT, demand is still strong, and is expected to continue growing but at a slower pace than in 2021. Additionally, last year left many backlogs to address in the new year.

We’ve recently experienced weeks of rising prices. Spot market rates usually cool down in the final quarter. However, if we look at 2020 prices for the same time period, the relief is not very much.

According to DAT, spot rates for dry van, reefer, and flatbed carriers are still on average 25% higher than the same week in 2020.

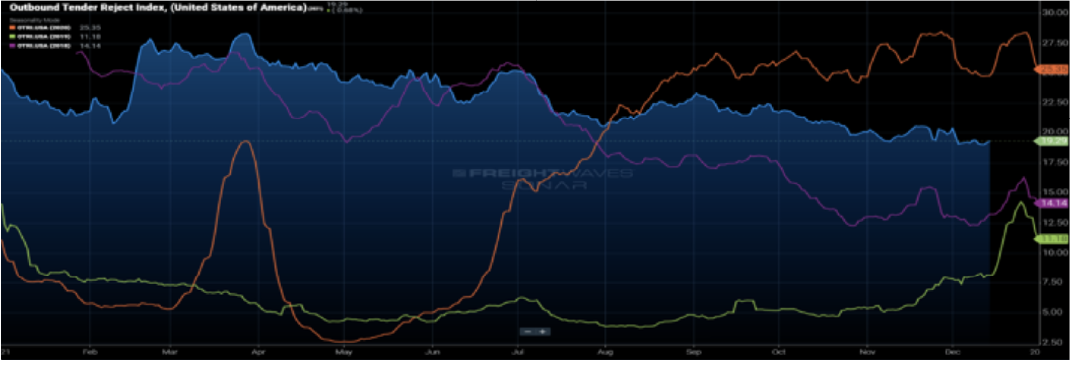

To better understand what is happening in the industry we will dive into two important indexes from Freightwaves’s SONAR, a freight forecasting platform that monitors domestic and global freight market activity.

- Outbound Tender Volume Index (OTVI) is an index of the volume of loads offered by shippers to trucking companies on a given day.

- Outbound Tender Rejection Index (OTRI) is the percentage of loads rejected compared to total loads offered by shippers under contract terms.

Shipping Demand

For the final season of 2021, demand didn’t show any sign of slowing down. Importers ordered supplies in high quantities to meet the consumer’s demand. The (OTVI) shows seasonal slowing, but it is also in line with the longer trend. See graphic below.

Source: Freightwaves Sonar

Source: Freightwaves Sonar

Shipping Supply

For the final quarter of 2021, rejection rates showed signs of improving capacity conditions. The (OTRI) shows that this index remains in line with the decreasing trend of recent months.

Source: Freightwaves Sonar

Source: Freightwaves Sonar

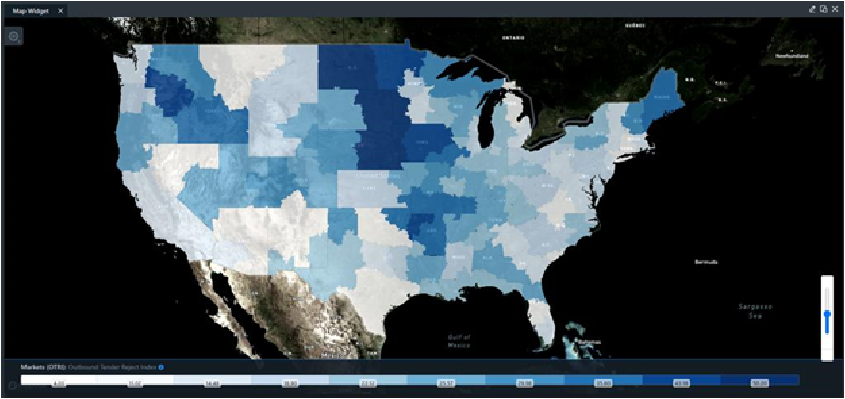

In the graphic below, we can see the states with higher tender rejection rates. States in the darker blue show a higher indicator. It may be more difficult to find capacity at this moment in those places.

Source: Freightwaves Sonar

Source: Freightwaves Sonar

The market for the first quarter of 2022 remains unclear but points towards gradual improvements in capacity conditions. It’s important to note that states such as Idaho, North Dakota, Maine, and New Hampshire still have very tight market conditions, and it is not easy for shippers to move their freight at this moment.

Port Congestion Situation

Los Angeles and Long Beach ports are working non-stop to ease the shipping container congestion caused by the supply chain crisis. The government established fines on the remaining cargo containers on docks. $100 per day per container left on the dock will be charged to carriers. They have a maximum of nine days to move containers before fines start. If containers need to be transported by rail, they have six days to move them.

Thanks to these “container dwell fees”, both ports have seen cargo container congestion reduced by 37%.

2021 Under Review

We wanted to write a recap of the most important industry events that took place in 2021. Last year, a lot of good things happened. Vaccinations were approved and administered. We attended events again and got together with the people we love. Restaurants and malls were full, and we had that feeling of “normalcy” again. However, there were also not-so-good things. Although we would have liked the pandemic to be over, it is staying longer than we expected. Then, the supply chain crisis happened, and many other factors occurred that slowed economic recovery.

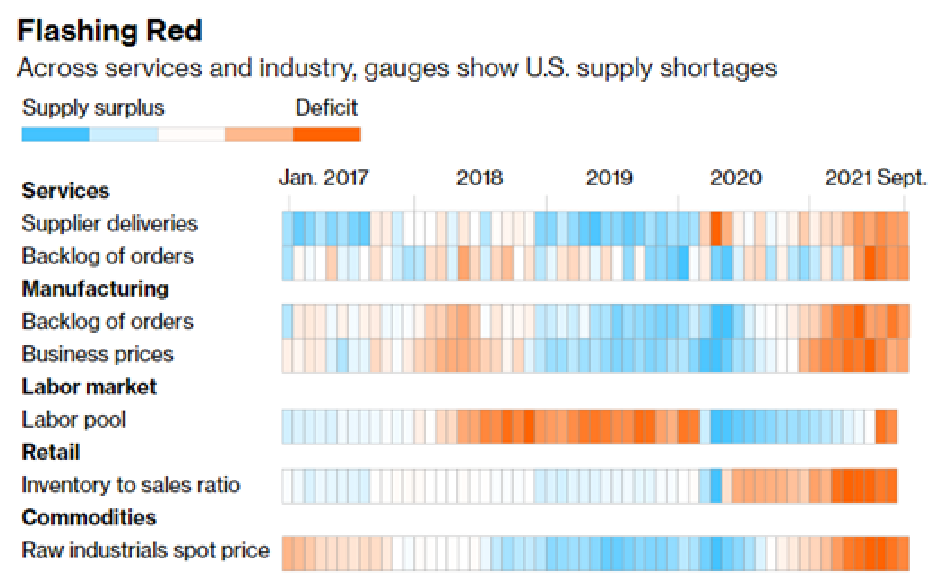

Supply Chain Disruptions

Ships stuck at ports, factories where production was halted because of supplies scarcity, empty shelves at supermarkets, rising price tags on almost all products, shortages of labor, and adding to all this, the Covid 19 pandemic.

In 2020, many manufacturers cut material orders because consumers stopped spending. However, in 2021 demand grew impressively and caught those producers off guard.

On the other hand, China, the world manufacturing powerhouse, had lockdowns due to the spread of Covid 19 which led to an increase in factory prices at a 10% annual rate, the fastest since 1990s.

From: Bloomberg Economics

From: Bloomberg Economics

Climate Issues Affecting the Supply Chain

- California’s Dixie fire was the second largest in state history. It burned approximately one million acres and almost 400 homes.

- Extreme floods in Canada and US caused significant damage.

- Hurricane Ida traveled up the east coast from New Orleans to New York, causing damage.

- Kentucky’s devastating tornado left hundreds of victims and destroyed millions of homes and businesses.

These weather events threatened logistics and transportation activities by making it difficult to move freight around.

Government Actions

The government took various actions and invested considerable money and time to mitigate the supply chain crisis. Within these actions, there are also plans to combat the Covid 19 and its new variants. The trucking action plan included steps to strengthen the Americas’ trucking workforce, help the victims of the climate crisis, and make investments in infrastructure like highways, bridges, and other improvements to make roads safer for drivers.

We are part of an ever-changing industry. Our purpose is to keep you informed with valuable industry insights to help you analyze your current supply chain situation and make the right decisions based on timely resources.

Remember GLT is always committed to offering the best service for all your logistic needs including: FTL, LTL, Drayage, Heavy Haul, Reefer, Expedited & Guaranteed movements.